_____________

-

Personal

Banking

Borrowing

Placeholder -

Business

Banking

Borrowing

Other Services

-

Investing

Wealth Strategies Group

Wealth Strategies Group -

About Us

In Our Community

Tools and Calculators

Student Line of Credit

Ukrainian Credit Union Limited offers Student Lines of Credit to cover your living or education costs while enrolled at an accredited Canadian university, college or American accredited schools granting postsecondary degrees and for up to twelve (12) months after graduation or residency (or up to six months if student withdraws from program early). While you are enrolled full-time in the program, interest only payments can be made monthly.

For all other international schools you will have to speak with your local branch rep to determine if you are eligible for a loan.

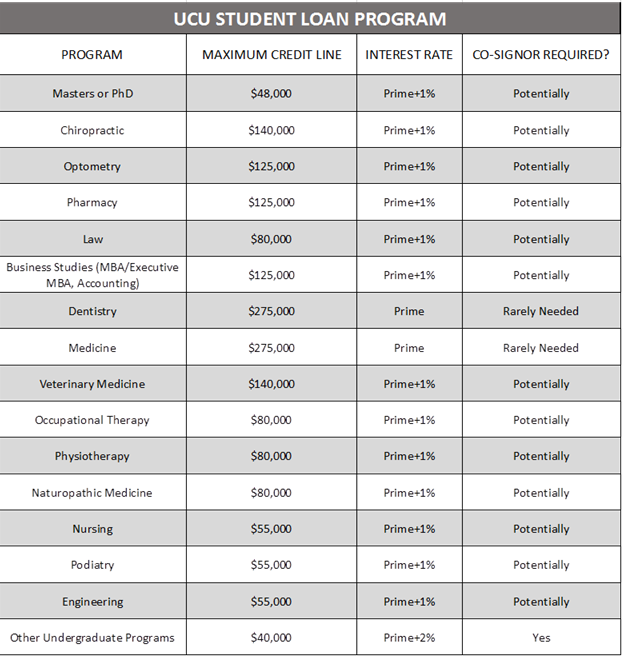

Credit limits will be established based on the type of program you are enrolled in, and the type of degree/diploma you will graduate with. Refer to TABLE 1 below for detailed program, credit limit maximum and interest rate information by area of study.

Prime refers to UCU's posted prime rate.

The maximum credit limit will be made available in equal installments for the duration of study (for example, an $80K credit line for a law degree will be made available in $20K increments in each of the four (4) years of study.)

Minimum Interest Rates:

- Prime (Medical and Dentistry)

- Prime + 1% (All other programs)

Terms:

Repayment while in school

While the student is enrolled full-time in their program of study, interest only payments must be paid monthly. Periodic lump sum payments will be allowed and are encouraged if students receive funds from other sources (parents, etc.,) to keep their cost of borrowing down.

Twelve (12) Month Grace Period

Students will enjoy the benefit of a 12 month grace period post-graduation during which time they can continue to make interest only payments without any requirement for principal repayment. This will give them time to secure suitable employment and get established. This grace period is optional at the student’s request and blended repayment may commence earlier if the student so wishes. The grace period may also be used for the purposes of medical residency’s, legal articling, or further post-secondary studies.

Extension of Grace Period

Requests for an extension of the initial 12 month grace period may be requested by the student in writing for consideration by UCU. Limits for the extension will be based on program of study, and are limited to:

1 Year – Law (to accommodate articling upon confirmation of assignment with a law firm)

2 Years – Dentistry (to accommodate specialized training if enrolled)

7 Years – Medicine (to accommodate residency upon confirmation of acceptance)

Post-Education Repayment

Once a student graduates and/or the 12 month grace period has passed, blended repayment of the credit facility must commence. The interest rate will remain at the same interest rate granted under the original line of credit, and the debt may remain as a line of credit or be converted to a blended payment personal loan. If the debt remains as a line of credit, blended repayment of a minimum of 3% of the outstanding balance will be required. Fixed payment option of principal and interest may also be available with a maximum amortization of 10 years. Approval of such requests will be handled on case by case basis, upon the request of the student/borrower.

Application Process:

Along with our normal personal loan application process, students will be required to provide confirmation of their acceptance and enrollment in an accredited college or university as well as a statement of tuition/residence fees owed. As well, students must provide satisfactory proof of enrollment annually as each incremental limit increase is requested. All schools have a standardized Confirmation of Enrollment or Verification of Enrollment form.

If a student is unable to produce acceptable confirmation of enrollment documentation, they will be deemed to have withdrawn from their educational program and the post education repayment program will commence.

Foreign Exchange Services

Savings

Wealth Management

Welcome to ucubiz